How to Download PF Passbook with UAN no

All PF eligible members can get their UAN number from their HR department. If you have a UAN no Please Login to download your PF Passbook Click here Download

IMPORTANT: To download PF Passbook first need to Register the UAN number is must if not registered please see this page to find how to register UAN number once you register, Please click on download then you will see the appended screen here you need to enter your UAN no and password

After login to the page you will see screen as below

To download the pass book need to click on DOWNLOAD tab as shown on the image above to download

PF Passbook to view detailed month wise contribution and interest added to you account it will be downloaded in PDF format.

Note: Existing registered UAN Member can download passbook in same day or next day

Newly registered UAN member need to wait for few days to download the passbook once they click on the download link they will get below message.

Latest passbook will be available only after 4 days for New UAN login activated members.

How to update profile and change password by clicking on PROFILE

1. EDIT MOBILE NO

2. EDIT EMAIL ID

3. UPDATE KYC INFORMATION

4. EDIT NOMINATION DETAILS

5. CHANGE PASSWORD

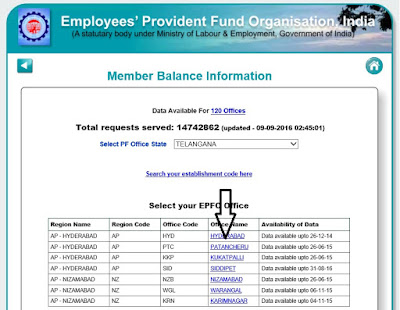

How to know UAN no please click here UAN No you will get below shown screen

1. Select State Name from the dropdown list

2. Select Regional Office from the dropdown list

3. In 3rd tab enter your Employer code number, 4th tab leave blank, 5th enter your PF number and click on check status you will see below screen.

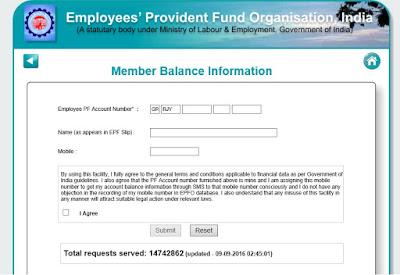

Here you need to provide details as per EPFO records.

1. Member Name (Employee Name) if you don't know name as per records Please check end of this page to find PF member name.

2. Date of Birth

3. Mobile number

4. Email ID

5.Choose password as per ((*Password should be alphanumeric, have minimum 1 special character and 8 to 25 characters long. (Special characters are one of ! @ # $ % ^ & * ))

6. Enter the Captcha as shown in the screen then click on submit button to get SMS for UAN details on your mobile.

How to Activate UAN no.

If you have not activated your UAN no, click here Activate UAN Based Registration you will get below screen.

1.Check the box for ‘I have read and understood the instructions’

2.Now enter your UAN number and mobile number.

3.Select the state and EPFO office from the dropdown list.

4.Also enter your Member ID in the related fields and click on ‘Get PIN.’.

6.You will receive your PIN to your submitted mobile number.

6.Now submit this PIN number to complete your UAN Activation process.

7.Once you finish activation, you will be able to create a login id and password.

8.Now every time you want to check your EPFO balance with your UAN number, login using your UAN number and password.

How to download PF Statement without UAN number

If you don't know UAN number and do not wish to activate it online, you can still download passbook online. Follow the captioned link and steps to know your EPF balance amount with e-passbook.

1.Click this link: http://members.epfoservices.in/

2.Use your identity document number and complete registration. You can register using your PAN card number or Adhaar card number. Other document numbers like ration card, passport, bank account, voter id, and license number are also valid for registration.

3.Select your document and enter all the personal details.

4.Enter captcha code and click on option ‘Get PIN’. Get PIN on your mobile and enter it.

5.Remember to check the box for ‘I agree’.

6.After registration, login using the document number and your mobile number.

7.Login to download EPF passbook and know your EPF balance in details.

You can login every time using this document number. You will also get a monthly SMS alert on your registered mobile number whenever the passbook is available.

How to know employee name as per records

Please follow the below steps to know the name as per records.

Here you can also know whether the employer is submitting your remittances on your name in PF returns or not to know please click here Find Name your will get screen as shown below.

Tick on I also know the establishment code and enter your employer code and press on search to view your employer name

Here we can also search establishment name or area pin code wise list of establishments and their remittances.

Please check your employer name and click on payment to view you month wise remittances of total no. of employees we will get screen as shown below.

Please click on no. of Employee to get remittances and member name under respective establishment you will see list of employees names are made by employer here we can search name by pressing CTRL+F and type name press enter to find name

All PF eligible members can get their UAN number from their HR department. If you have a UAN no Please Login to download your PF Passbook Click here Download

IMPORTANT: To download PF Passbook first need to Register the UAN number is must if not registered please see this page to find how to register UAN number once you register, Please click on download then you will see the appended screen here you need to enter your UAN no and password

After login to the page you will see screen as below

To download the pass book need to click on DOWNLOAD tab as shown on the image above to download

PF Passbook to view detailed month wise contribution and interest added to you account it will be downloaded in PDF format.

Note: Existing registered UAN Member can download passbook in same day or next day

Newly registered UAN member need to wait for few days to download the passbook once they click on the download link they will get below message.

Latest passbook will be available only after 4 days for New UAN login activated members.

How to update profile and change password by clicking on PROFILE

1. EDIT MOBILE NO

2. EDIT EMAIL ID

3. UPDATE KYC INFORMATION

4. EDIT NOMINATION DETAILS

5. CHANGE PASSWORD

How to know UAN no please click here UAN No you will get below shown screen

1. Select State Name from the dropdown list

2. Select Regional Office from the dropdown list

3. In 3rd tab enter your Employer code number, 4th tab leave blank, 5th enter your PF number and click on check status you will see below screen.

Here you need to provide details as per EPFO records.

1. Member Name (Employee Name) if you don't know name as per records Please check end of this page to find PF member name.

2. Date of Birth

3. Mobile number

4. Email ID

5.Choose password as per ((*Password should be alphanumeric, have minimum 1 special character and 8 to 25 characters long. (Special characters are one of ! @ # $ % ^ & * ))

6. Enter the Captcha as shown in the screen then click on submit button to get SMS for UAN details on your mobile.

How to Activate UAN no.

If you have not activated your UAN no, click here Activate UAN Based Registration you will get below screen.

1.Check the box for ‘I have read and understood the instructions’

2.Now enter your UAN number and mobile number.

3.Select the state and EPFO office from the dropdown list.

4.Also enter your Member ID in the related fields and click on ‘Get PIN.’.

6.You will receive your PIN to your submitted mobile number.

6.Now submit this PIN number to complete your UAN Activation process.

7.Once you finish activation, you will be able to create a login id and password.

8.Now every time you want to check your EPFO balance with your UAN number, login using your UAN number and password.

How to download PF Statement without UAN number

If you don't know UAN number and do not wish to activate it online, you can still download passbook online. Follow the captioned link and steps to know your EPF balance amount with e-passbook.

1.Click this link: http://members.epfoservices.in/

2.Use your identity document number and complete registration. You can register using your PAN card number or Adhaar card number. Other document numbers like ration card, passport, bank account, voter id, and license number are also valid for registration.

3.Select your document and enter all the personal details.

4.Enter captcha code and click on option ‘Get PIN’. Get PIN on your mobile and enter it.

5.Remember to check the box for ‘I agree’.

6.After registration, login using the document number and your mobile number.

7.Login to download EPF passbook and know your EPF balance in details.

You can login every time using this document number. You will also get a monthly SMS alert on your registered mobile number whenever the passbook is available.

How to know employee name as per records

Please follow the below steps to know the name as per records.

Here you can also know whether the employer is submitting your remittances on your name in PF returns or not to know please click here Find Name your will get screen as shown below.

Tick on I also know the establishment code and enter your employer code and press on search to view your employer name

Here we can also search establishment name or area pin code wise list of establishments and their remittances.

Please check your employer name and click on payment to view you month wise remittances of total no. of employees we will get screen as shown below.

Please click on no. of Employee to get remittances and member name under respective establishment you will see list of employees names are made by employer here we can search name by pressing CTRL+F and type name press enter to find name